Appearance

Debt Pool

A Debt pool is a smart contract that anyone can deploy and manage. Debt pools are used by borrowers to raise a credit line, and current pools function as revolving credit pools.

Pool Parameters

When a borrower opens a pool, they decide on the following parameters:

- Max pool size – The total value that can be staked to the pool

- Interest rate – The interest rate the borrower will pay on borrowed capital (currently the borrower pays no capital on staked but unborrowed capital)

- Min stake size – Small amount of capital a capital provider can deposit to the pool

- Interest payment intervals – How often does the borrower commit to pay interest: monthly, bi-monthly, etc.

- Redemption period – How often can a capital provider ask to redeem their capital: weekly, monthly, bi-monthly, quarterly, semi-yearly, yearly

Debt Pool Life Cycle

- Capital providers can deposit funds into the pool and receive debt tokens representing their share, immediately collecting fees of the current borrowed capital

- The borrower can borrow the deposited capital at the predetermined interest rate

- Interest is only paid on the capital actually borrowed from the pool, not on idle funds

- Borrowers can borrow and repay the pool multiple times

- Lenders can choose how they want their interest to be managed—either as a compounding asset, where the interest earned is reinvested into the pool, or as regular payouts received at predetermined intervals

Interest Calculation

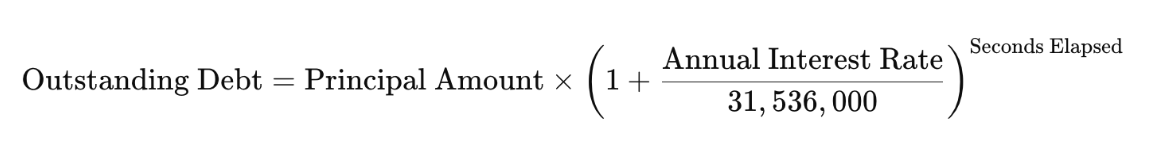

Interest is calculated as compounded per second using the formula:

Where:

- Outstanding Debt = Total amount owed including accrued interest

- Principal Amount = Initial borrowed amount

- Annual Interest Rate = Yearly interest rate (as a decimal, e.g., 0.10 for 10%)

- 31,536,000 = Number of seconds in a year (365 days)

- Seconds Elapsed = Time since borrowing began, in seconds

Example:

If a borrower takes out $100,000 at 10% annual interest, after 1 year (31,536,000 seconds), the outstanding debt would be approximately $110,517. The continuous compounding yields slightly more than simple 10% due to the per-second accrual.

Debt Tokens (ERC-20 Standard)

Debt tokens in Textile are implemented as standard ERC-20 assets, making them interoperable with the wider DeFi ecosystem. When capital providers deposit funds into a debt pool, they receive debt tokens representing their proportional claim on the pool.

Unlike idle assets, interest payments made by borrowers are automatically restaked into the pool, increasing the underlying value of each token. This ensures that token holders benefit from compound growth without needing to take additional action.

On the secondary market, debt tokens behave like any other ERC-20 token—their price and liquidity are determined by supply, demand, and the broader market dynamics that develop around them.

Capital Provider Withdrawal

Each pool has a "Redemption period" which stands for how often a lender can get their principal back.

Example: A pool was created on October 1, 2024, with a yearly redemption period. The next time a capital provider can receive their principal is on October 1, 2025.